Compound Interest Calculator

Want to see the magic of compounding? Our free compound interest calculator shows how small, regular investments can snowball into big returns over time. Just enter your principal, interest rate, and time to visualize your wealth growth. Ideal for investors, students, and retirement planners. Start calculating your financial future today!

Share Calculator

Related Calculators

Understanding Compound Interest:

Here, what kind of topic is compound interest, what kind of topic is it, and what things are said here? We know here, so what is the difference between simple and compound interest? For example, if we are giving you $100 and giving it at the rate of 10%, then as per simple interest, The interest calculated in the first year will also be $100, the interest calculated in the second year will also be on $100, the interest calculated in the third year will also be on $100, and the interest that will come every year will be fixed and will be $10. But when we talk of compound interest, it means that in the first year, the interest we will get here is 10% of $100, that is, $10. Now, the interest in the first year will come to you, so what you will do here is add $10 to $100, and then it will become $110. Now, your principal is no longer $100; it has become $110. The interest that will be calculated will be on top of $110. Then we will find out it is 10%, which is $11, and by doing this, the value will keep on adding; that is, compound interest means that you get interest on the principal as well as the interest on the interest. So here, this value is much bigger than simple interest. We will calculate the entire compound interest in three ways, and these three methods are quite popular. First, if we talk about it here, the first method is the ratio method, and the second is the successive method. And the third is the tree method.

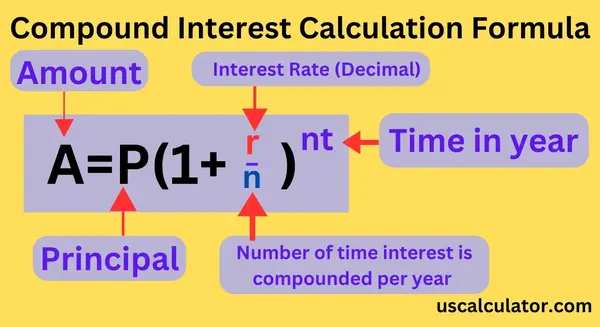

Compound Interest Calculation Formula

Compound interest is the "interest on interest" that makes your money grow faster over time. Unlike simple interest, it reinvests earnings, creating exponential growth. Here's how to calculate it with real-world examples.

Compound Interest Formula

The standard compound interest formula is:

| A = P × ( 1 + |

| ) n × t |

Where:

A = Future value of investment, Final amount (including interest)

P = Principal amount (initial investment)

r = Annual interest rate (in decimal)

n = Number of times interest is compounded per year

t = Time in years

Total Interest Earned:

Interest = A - P

Compound Interest Examples

Example 1: Annual Compounding (n=1)

let's look at an actual example. Suppose you invest $100,000 at an annual interest rate of 8%, with interest compounded once per year. for 5 years. When we enter these figures into the compound interest formula, we get the following -

Principal (P): $100,000

Annual Rate (r): 8% (0.08)

Time (t): 5 years

Compounding (n): Once per year

Calculation:

| A = 100,000 × ( 1 + |

| ) 1 × 5 = 100,000 × (1.08) 5 = $146,933 |

Interest Earned: $146,933 - $100,000 = $46,933

Example 2: Monthly Compounding (n=12)

let's look at an actual example. Suppose you invest $100,000 at an annual interest rate of 8%, with interest compounded once per month. for 5 years. When we enter these figures into the compound interest formula, we get the following -

Principal (P): $100,000

Annual Rate (r): 8% (0.08)

Time (t): 5 years

Compounding (n): 12 times/year

Calculation:

| A = 100,000 × ( 1 + |

| ) 12 × 5 = 100,000 × (1.006667) 60 = $149,175 |

Interest Earned: ₹1,49,175 - ₹1,00,000 = ₹49,175

let's look at an actual example. Suppose you invest $5,000 at an annual interest rate of 6%, with interest compounded once per Quarterly. for 2 years. When we enter these figures into the compound interest formula, we get the following:

Example 3: Compounded Quarterly

Principal (P) = $5,000

Interest Rate (r) = 6% = 0.06

Time (t) = 2 years

Compounded quarterly (n = 4)

| A = 5,000 × ( 1 + |

| ) 4 × 2 = 5,000 × (1.015) 8 = $5,000 × 1.1268 = $5,634 |

Compound Interest Earned = $5,634 - $5,000 = $634