Future Value Calculator

Are you interested in discovering the potential growth of your savings? Our future value calculator shows how your money grows with compound interest. Just enter your initial investment, interest rate, and time to see your potential return.

Share Calculator

Related Calculators

Table of Contents

What is Future Value?

If we talk about future value, it is the amount of money that will grow with time, and we get compound interest on our amount. You must have seen that when you do FD in a bank, you get an interest rate on it, so understand the amount you will get in the future. today's value of money is the present value, and how much will I get today, what will be the future value? It is the future cash flow and the future value of this present value. And when you do a $100000 FD in a bank. And that is 5. years of FD. Now, the amount you will get after 5. Years of $100000 with compound interest is the future value. We need to understand future value. Future return on investment is an important statistic that can help you plan and make investment decisions in the future.

Future Value Calculation: Formulas & Examples

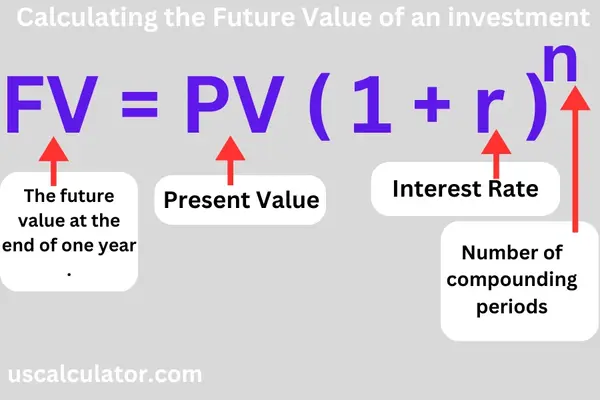

Here we talk about future value. To calculate the future value, it is important to understand its calculation formula well. While the future value calculator streamlines the process, having a basic understanding of the formula can deepen your financial literacy. The future value formula is:

Discover how to calculate what your money will be worth in the future with compound interest. Essential for savings, investments, and financial planning.

1. Future Value FormulasA. Basic Future Value (Lump Sum Investment)

FV = PV × (1 + r)n

Where:

FV = Future Value

PV = Present Value (initial investment)

r = Interest rate per period

n = Number of periods

B. Future Value of Regular Investments (Annuity)

| FV = PMT × [ |

| ] |

Where PMT = Regular payment amount

C. Future Value with Continuous Compounding

FV = PV × er × n

Where e = 2.71828 (Euler's number)

2. Calculation ExamplesExample 1: Single Investment (Lump Sum)Initial Investment (PV): $10,000

Annual Interest Rate (r): 6% (0.06)

Time (n): 10 years

Calculation:

FV = 10,000 × (1+0.06)10 =10,000 × 1.7908 = $17,908

Interpretation:

Your $10,000 grows to $17,908 in 10 years at 6% annual interest.

Example 2: Monthly Savings (Annuity)Monthly Deposit (PMT): $500

Annual Interest Rate (r): 5% (monthly rate = 0.05/12)

Time (n): 20 years (240 months)

Calculation:

| FV = 500 × [ |

| ] = 500 × 411.03 = $205,515 |

Interpretation:

Saving $500/month grows to $205,515 in 20 years at 5% interest.

3. Rule of 72 (Quick Estimation)

Estimate doubling time:

| Years to Double = |

|

At 8% interest: 72 ÷ 8 = 9 years to double your money.